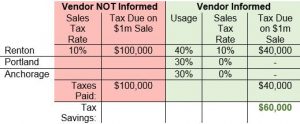

PSJH deals in multiple states with varying sales tax, ranging from 0% to over 10%. The budget owner and/or requestor should provide the vendor the location where each good or service is being used, so the vendor applies the appropriate sales tax. If the vendor is not informed, they may likely charge sales tax based on either the Ship To or the AP address.

Scenario

Here’s a simple example in how use tax can make an impact. If you have a $1M service supporting an application used 40% in Renton, 30% in Portland, and 30% in Anchorage you would provide the percentage usage breakdown by location to the vendor, or to the PSJH tax team if seeking an MPU. The sales tax would then be adjusted based on the usage distribution. In this scenario, if Renton is the address the vendor would have used, the tax savings by informing the vendor is $60,000.

Resources

- Review the Sales Tax section in the IS Budget Controls and Processes SOP document.RE

- Attend the next quarterly IS Budget Owner Training the week of December 17th or go here for self-training.

- Use this template for assistance in gathering the usage tax information.

Contact

Please contact Deanna Lunsford, Manager, IS Operations, with any questions.